RCM Overview

Founded in 1999, RCM (Real Capital Markets) is a global marketplace for listing, marketing, and buying commercial real estate (CRE) assets and notes. It bridges real estate investors and capital markets based on tenets of transparency and qualified exposure.

Since its inception, RCM has been innovating the CRE industry for over ten years.

In 2000, the company completed its first year in business and launched an Executive Summary Teaser.

In 2003, RCM released the branded Virtual Deal Room for buyers and sellers. And in 2007, the company released the Listing Engine to help sellers manage their listing pages without coding. The Listing Engine was followed by the release of the Deal Center in 2009 to help buyers track and manage their deal flow.

RCM has kept its innovation spirit high, with the Auction platform launching in 2014. In 2017, the company released inSIGHT, enabling users to capture, analyze and optimize their capital markets portfolio’s under one dashboard.

How does RCM work?

RCM brings the entire real estate investment sales and marketing process under one integrated platform. It achieves that through business intelligence solutions such as:

Qualified buyer database

Understanding the importance of an accurate contact list: RCM built the buyer database to help sellers reach qualified and active investors for asset types within the CRE industry. The said database is maintained daily by an in-house research team that employs strict screening measures to qualify decision-makers.

With clean and accurate investor data: Sellers can quickly target relevant investors based on different acquisition parameters. (Resulting in increased buyer participation, more offers, and maximum pricing.)

Marketing toolkit

In addition to a well-maintained buyer database, RCM enables sellers to design and modify commercial property websites that are brand and mobile-friendly. It also enables them to populate the page with interactive maps, images, and other property details – without coding.

The company provides multiple templates with expanded variety and personalization. It also boasts a built-in map, photo gallery, and statistics sections.

Beyond the professional-looking website, a seller can take charge of their communication through branded emails. They only need to select a template, customize it, add links, and schedule their broadcast. The RCM’s advanced email delivery infrastructure helps avoid the spam folder by 99%, while the real-time campaign reporting provides insights to help improve one’s email marketing strategy.

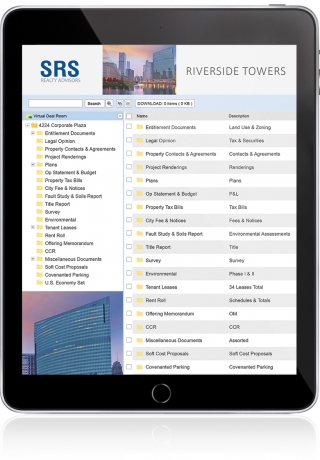

Virtual Deal Room®

A secure and efficient virtual data room that can support the whole sales process is critical in today’s real estate investment sales environment. RCM delivers a secure, intuitive, and cost-effective solution for sharing and accessing due diligence and other materials.

The product is equipped with full-coverage tracking and reporting to offer insights into who, where, when, and how prospects interact with the shared documents.

Online Auctions

RCM auction platform is designed to enhance buyer participation, transparency, and faster closing.

It gives sellers control over the auction process: timing, marketing timeframes, and broadcast schedules. It also integrates with other RCM tools to help sellers better manage property marketing, due diligence, bidding, and closing.

For buyers:

Deal Center

A product that enables buyers to access investment opportunities that match their unique buying criteria.

Upon registering to the Deal Center Premium, buyers can unlock helpful research tools that speed up deal making. For example, they can research market conditions, test new investment strategies, examine property inventories, etc., to discover new opportunities.

Buyers can also use the tools to generate comprehensive reports to accelerate decision-making.

For enterprises:

RCM inSIGHT

A product that revolutionizes the way enterprises – investment management firms, institutional investors, REITs, CRE funds, etc. – capture, analyze, and organize their capital markets portfolio insights.

RCM inSIGHT aggregates the disparate data generated in the sales cycle into a centralized database for optimal data accessibility and transparency. With it, enterprises can monitor interested prospects, bids, cap rates, purchase price, and more – all in a single platform.

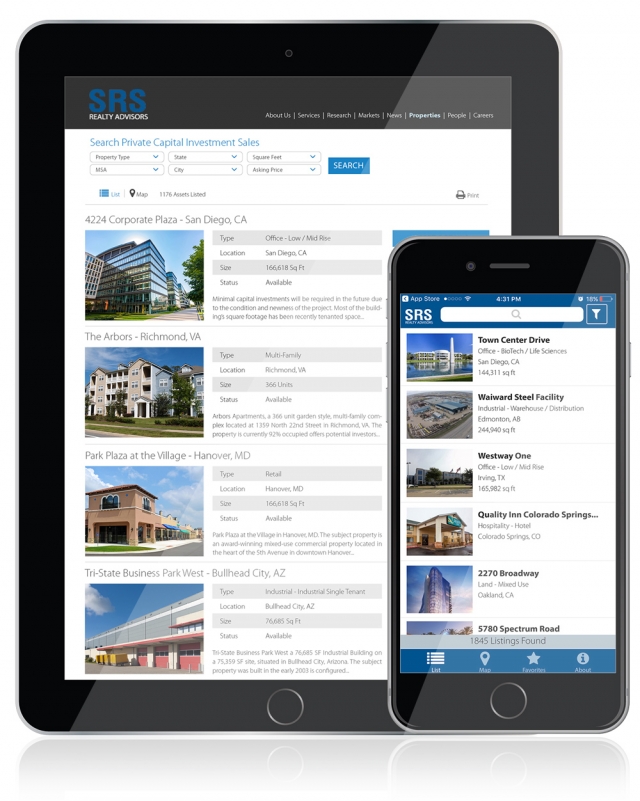

Listing engines

Real Capital Markets makes it easy for one to update listings on their website without coding. Once a user set up the listing engine, it’ll work silently (but reliably) to populate the listings with data and information input into the RCM system.

Users have control over what information is visible to viewers and can easily track the actions of those viewing property photos, teasers, etc.

Who is RCM for?

RCM is ideal for principal investors, exclusive listing brokers, mortgage bankers & equity sources.

In other words, Real Capital Markets is suitable for:

Buyers looking to:

- Source commercial property deals that meet their unique investment criteria

- Purchase real estate assets in traditional sealed-bid formats and online auctions

- Securely store and share confidential documents

- Manage deals, and associated commercial real estate documents in one dashboard

Sellers looking to:

- Easily and quickly create property websites

- Market properties to qualified principals

- Create, manage, and track branded email campaigns

- Sell assets in traditional sealed-bid formats and online auctions

- Securely share underwriting, due diligence, and other confidential documents

- All without coding skills

Commercial real estate organizations looking to:

- Add, remove, or update listings on their website without coding

- Aggregate historical and current data in a single dashboard for more informed decision making

Currently, RCM clientele base consists of different organizations: from entrepreneurial-local businesses to multinational corporations. Corporations such as CBRE, Colliers International, JLL, Cushman & Wakefield, and Avison Young.

RCM Alternatives

Despite achieving great heights: 76,000+ deals brought to market, $2.5 Trillion+ CRE transactions, 72,000+ qualified Principals, etc.; RCM operates in a red ocean market, with some well-known RCM alternatives such as:

- SharpLaunch

- Brevitas

- CREXi

- RCA

- Secure Docs

- Bamboo Auctions

RCM Pricing

Real Capital Markets does not publish details about its pricing. According to their site, pricing depends on one needs. And since each real estate industry participants have unique needs, it’s hard to find a standard RCM pricing list online.

Moreover, one can choose to expand their investment deal management one tool at a time. Or leverage the all-in-one toolset to seamlessly market, manage, and close property listings. (Which further contributes to pricing disparities.)

It’s, therefore, best to contact RCM’s sales team to identify the pricing package that suits one’s listing needs.

RCM Contact Information

As an established brand in the CRE industry, RCM has several contact methods available.

For instance, users can reach them directly through their contact form in case of non-urgent queries. They can also email them at brand@rcm1.com or call them via phone at 1-760-602-5080 (in case of urgent inquiries).

In case of questions: one can call their client services at 1-888-546-5281.

RCM Login Information

Accessing the RCM log in is a quick process that requires a few basic information: name, email address, and industry role. Once a user has signed up and confirmed their registration via email, they can access their free dashboard by logging in using their registration details (email and password). Then proceed to manage their deal flow, projects, acquisition criteria, etc.